Posted 27 July 2022

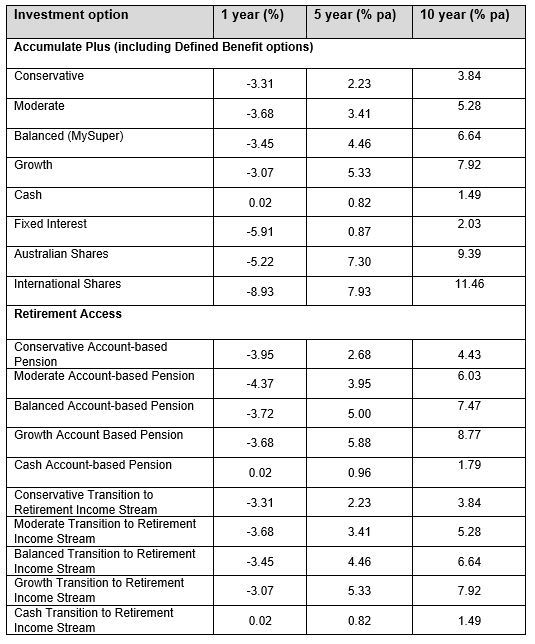

In June 2022, we published an article about the recent market volatility and the impact on super. Below is a further update, which also includes investment returns for our investment options to 30 June 2022.

Over the last few months, significant volatility and negative returns have been prevalent across shares, bonds and many other asset types. The drivers continue to be due to higher inflation, interest rate increases, COVID lockdowns and the Ukraine war causing supply chain and commodity price volatility. Global share and bond markets simultaneously experienced large falls over the year to date – a rare occurrence.

Challenging conditions have been faced across financial markets this year, which has affected investors across the board, with the vast

majority of MySuper products expected to posting negative returns for the financial year.1

Over the financial year, share markets returned -6.8%2 in Australia and -9.4%3 globally. While historically fixed interest markets would generally cushion share market falls, this time around they were heavily impacted by inflationary concerns and the lifting of interest rates – with fixed interest markets returning around -10%4 over the year.

Given current market uncertainties, we expect volatility to continue over the short term and are cognisant of the potential for lower returns from share markets over the short to medium term as central banks continue to tackle higher inflation.

While allocations to share market exposure are important to achieve long term growth of your super, we will continue developing our allocation to diversified strategies - not only to help protect your savings from share market volatility, but also to access alternative sources of return.

Alongside this, we will continue to focus on and implement of our Climate Action plan, including the evolution of our investment portfolio to meet our 2050 net zero emissions commitment.

1 Information published by SuperRatings as part of their monthly Fund Crediting Rate Survey (FCRS) showed only 3 out of 50 MySuper options within the SR50 MySuper peer group posted positive returns for the financial year to 30 June 2022. Data sourced from SuperRatings Pty Ltd (ABN 95 100 192 283, AFSL 311880).

2 Australian shares - S&P/ASX 300 Accumulation Index,; Global shares - MSCI ACWI ex Australia Net 25% Hedged index; Australian fixed interest - Bloomberg AusBond Composite 0+ Years Index (returning -10.5%); and Global fixed interest - Bloomberg Barclays Global-Aggregate Bond Ex-CNY TR Hedged AUD (returning -10.25%). The S&P/ASX300 is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by Commonwealth Bank Officers Superannuation Corporation (CBOSC). CBOSC products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and do not make any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the S&P/ASX300.

3 The MSCI data is comprised of a custom index calculated by MSCI for, and as requested by, the trustee of Commonwealth Bank Group Super. The MSCI data is for internal use only and may not be redistributed or used in connection with creating or offering any securities, financial products or indices. Neither MSCI nor any other third party involved in or related to compiling, computing or creating the MSCI data (the ‘MSCI Parties’) makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and the MSCI Parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to such data. Without limiting any of the foregoing, in no event shall any of the MSCI Parties have any liability for any direct, indirect, special, punitive, consequential or any other damages, including lost profits) even if notified of the possibility of such damages.

4 Bloomberg® and Bloomberg AusBond Composite Bond Index 0+yrs and Bloomberg Global Aggregate Hedged AUD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by the trustee of Commonwealth Bank Group Super (“the trustee”). Bloomberg is not affiliated with the trustee, and Bloomberg does not approve, endorse, review, or recommend any trustee’s Accumulate Plus or Retirement Access products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the trustee’s Accumulate Plus or Retirement Access products.